How Often Is A Registered Rep Subject To The Firm Element Of Continuing Education?

For those working within the securities manufacture, the Financial Manufacture Regulatory Say-so (FINRA) serves to ensure their protection through a fair financial market.

This means that anyone selling securities products has to undergo the necessary testing to prove their qualifications and obtain their license. This likewise extends to advertisements, which FINRA works to proceed truthful then that total disclosure on all investment products is available prior to purchasing.

But how does FINRA maintain this level of integrity? By requiring all certified individuals and organizations to complete FINRA continuing didactics.

What is FINRA Standing Education?

All investors and organizations working within the securities industry are required to consummate Continuing Educational activity (CE) in lodge to continue working and adhering to their standards of integrity. This is a similar procedure to fulfilling Continuing Professional Education (CPE) for other finance and accounting certifications.

There are two levels to FINRA's continuing education requirements— the Regulatory Element and the Business firm Element. Meeting these requirements is crucial to continuing work within the securities industry.

While information technology tin be overwhelming trying to keep runway of the specifications of both elements, we've got you covered. Keep reading for a comprehensive breakdown of both the Regulatory and Firm Element, as well as recommended courses for each.

FINRA CE Regulatory Element Programs

This portion of FINRA CE is squarely focused on regulatory sales practice standards as well as compliance and ethical conduct. The material for the Regulatory Element is built upon industry regulations and rules as well equally practices and standards of the industry.

Those undertaking this element must exhibit a practiced level of knowledge to meet their CE requirements. All individuals must cease figurer training sessions inside of 120 days later on the second anniversary of their original date of registration; failure to do so will return your registration inactive. This requirement must be fulfilled once again every three years subsequently. Luckily, there are courses bachelor online that tin can help you to encounter these specifications.

Each program for the Regulatory Element consists of a set of modules. You're required to complete these modules in order to demonstrate your proficiency and understanding of their underlying concepts. You should expect to repeat some case studies until you lot adequately brandish proficiency in them. Nigh all of these requirements must be met inside 120 days of your registration anniversary date— so y'all have a little over a year from first becoming FINRA certified to consummate them. S201 is the exception, since it must be met ii years after passing your exam.

Here's a quick breakdown of the unlike regulatory element programs:

- S101: This program is required for all FINRA license holders except Series vi. The content is carve up into 4 modules that embrace regulatory and operational responsibilities, in addition to other responsibilities for their customers. The fourth module goes into more specific detail based on common chore functions, such equally retail sales and investment banking. For more than info, check out the total plan outline on FINRA's site hither.

- S106: This CE programme is specifically for Serial half-dozen holders and contains 5 modules of content. It'due south related to the duties of an investment company products representative, including topics similar suitability and communicating with the public. For more info, see this content outline from FINRA'south website.

- S901: Series 99 holders are required to meet this 4-module CE plan. It covers necessary cognition areas and duties of operations professionals, including workflow, confidentiality, and personalized case studies. Yous can acquire more by reading the full FINRA outline here.

- S201: This CE program must be completed by all supervisors and principles, which includes Series 24 license holders. The 4 modules contained in this program cover subjects related to supervising and handling customer accounts, corporate finance, and other considerations. A full outline can be found here.

FINRA Continuing Education House Element Programs

The Firm Chemical element differs from the Regulatory Element because information technology'due south more specific to a given broker-dealer. Basically, this CE program requires firms to build a training program for their registered personnel.

Broker-dealers must enforce their Firm Chemical element CE Program in conjunction with an annual Needs Analysis and Written Grooming Programme. They must besides keep written history and documentation of the content included inside these courses too as tape of program completion.

FINRA provides Firm Chemical element Advisory guidelines that assistance identify fundamental sales practice issues and regulations that broker-dealers should have into consideration for such programs. They also provide a listing of guidelines for the Firm Element in their Guide to Firm Element Needs Analysis and Training Plan Evolution.

Here's the nearly of import takeaway about this standing education program— the training needs of the private or their firm as a whole must exist revisited annually and focus on ethical and professional person conduct.

They must also comprehend iii principal categories:

- General Investment Features + Associated Gamble Factors

- Suitability and Considerations for Sales Practices

- Regulatory Requirements (where applicative)

Best FINRA CE Online Programs

At present that you lot know the different CE programs for each license, check out these recommendations for meeting your specific professional requirements:

Best Regulatory Chemical element Training Courses

Starting with the Regulatory Element, nosotros recommend using Securities Institute of America. Their courses are designed so that you tin have them online or at a testing center.

When taking courses with The Securities Institute of America, you lot have 120 days to complete each department. But other than this loose guideline, these courses are essentially self-paced. You're complimentary to start and stop whenever you similar, taking long breaks in between if you lot desire; this is helpful if you demand some flexibility due to an already packed schedule.

The testing middle option is great if you don't mind paying a bit more for an expedited experience. But if not, the online portal volition still help you learn and master the cloth within each department thanks to a large library video preparation, reading assignments, and Q&A tests.

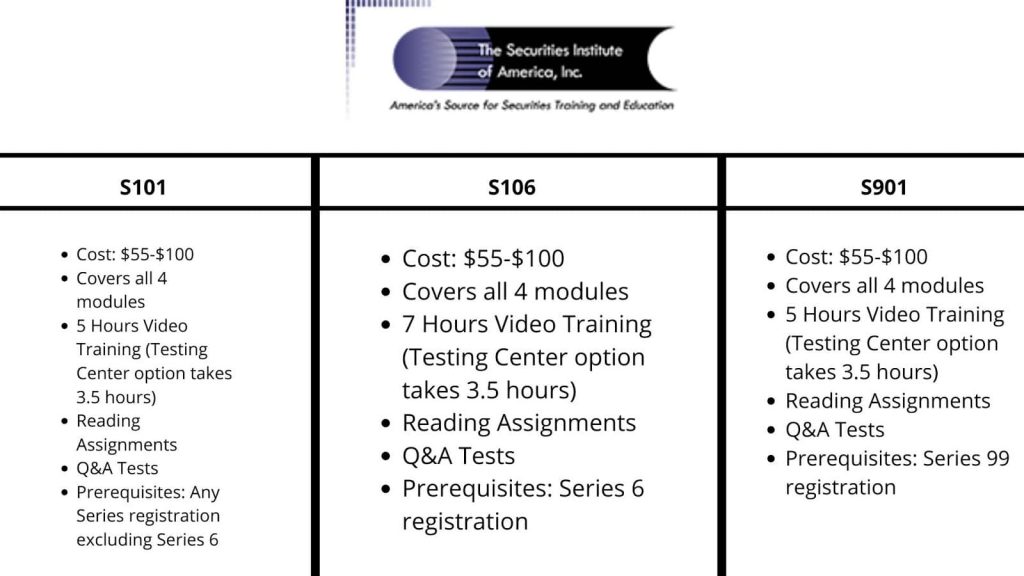

Here are the courses we recommend from The Securities Institute of America:

S101 Regulatory Standing Didactics Prep Course

- Cost: $55-$100

- Covers all iv modules

- 5 Hours Video Training (Testing Center selection takes 3.5 hours)

- Reading Assignments

- Q&A Tests

- Prerequisites: Any Series registration excluding Serial six

S106 Regulatory Standing Education Prep Course

- Cost: $55-$100

- Covers all 4 modules

- seven Hours Video Training (Testing Heart option takes iii.5 hours)

- Reading Assignments

- Q&A Tests

- Prerequisites: Serial 6 registration

S901 Regulatory Continuing Education Prep Course

- Cost: $55-$100

- Covers all 4 modules

- 5 Hours Video Training (Testing Middle option takes 3.5 hours)

- Reading Assignments

- Q&A Tests

- Prerequisites: Series 99 registration

All-time FINRA Business firm Element Training

Most companies in the securities manufacture are understandably busy— peculiarly now that interest in retail trading is growing.

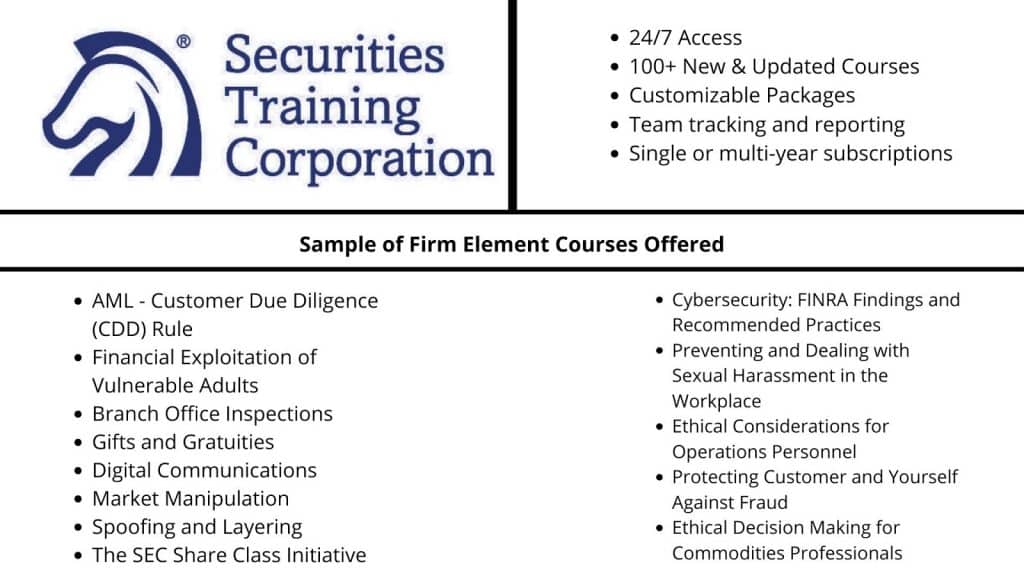

Companies looking to ensure their employees see continuing education requirements for their licenses can greatly benefit from Securities Training Corporation. Their suite of CE courses guarantees minimal time loss, allowing for your firm's focus and energy to exist spent on the topics that matter about to making money.

Their pick is vast, including over 100 new and regularly updated courses. Employees will also take unlimited access to the content, and each package is customizable to scale to your company's size and needs.

Todd Talks Continuing Education

If you lot and your company similar the experience, STCUSA also offers single and multi-year plans for banker-traders. They also host an Annual Compliance Coming together via webcast which allows firms to choose item subjects relevant to their specific needs.

One feature that's specially helpful for managers is tracking and reporting. Securities Grooming Center'south online portal generates and shares information for your entire squad. Consequently, you tin easily proceed upwardly with your team'due south progress.

FINRA CE FAQs

Nonetheless confused well-nigh FINRA continuing education? Bank check out these commonly asked questions:

What practice I need to complete my CE requirements from FINRA?

FINRA requires that individual license holders complete the Regulatory Element, and banker-traders complete the House Chemical element. These programs can be completed online through FINRA's website or in-person at a FINRA-approved testing center.

How oft do I need to consummate the FINRA Regulatory Chemical element?

You volition demand to consummate the Regulatory Element within 120 days of the anniversary of your initial series registration. This needs to be completed once again every iii years thereafter.

How often do I demand to consummate the FINRA Firm Element?

This is something that your business or firm should be revisiting on an annual basis in order to go along everyone upward to appointment with ethical and professional standards.

How Often Is A Registered Rep Subject To The Firm Element Of Continuing Education?,

Source: https://www.ais-cpa.com/breakdown-finra-continuing-education/

Posted by: carrawayenticippace.blogspot.com

0 Response to "How Often Is A Registered Rep Subject To The Firm Element Of Continuing Education?"

Post a Comment